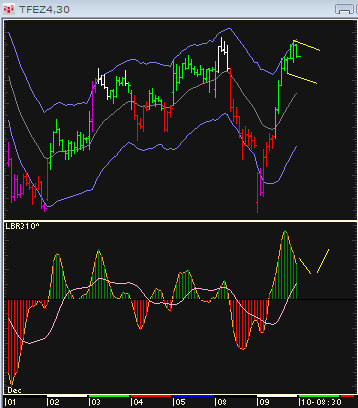

Two Averages Oscillator

This simple indicator is the result of the difference between two moving averages,

MA difference, MA Delta.

To work install 20 in 1 Moving Average Indicator a.k.a. Averages

viewtopic.php?f=17&t=2430

Select 1. Indicator

Select 2. Indicator

Calculate difference between two.

Both are using chart price data as a source.

Select Indicator 1. Source Indicator

Select Indicator 2. Source Indicator

Both are using chart price data as a source.

Select Indicator 3

Select Indicator 4

Indicator 3 is using Indicator 1. as source.

Indicator 4 is using Indicator 2. as source.

Calculate difference between two.

Both are using chart price data as a source.

The indicator was revised and updated